National Minimum Wage 2026 for Care Providers:

Compliance Risks and FWA Enforcement

Text to speech

Duration: 00:00

Font size

Published: 11 Feb, 2026

Share this on:

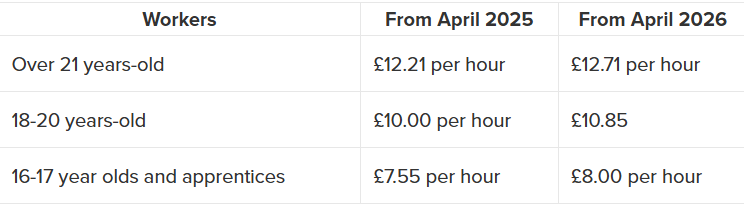

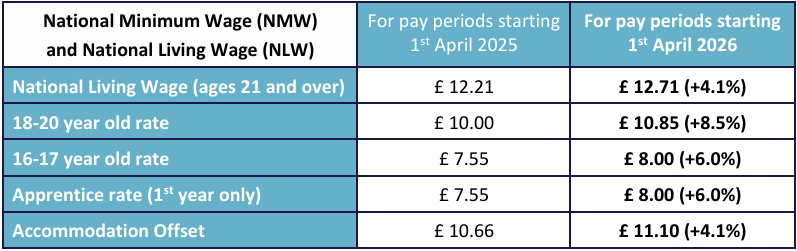

From 1 April 2026, the National Minimum Wage and National Living Wage 2026 rates increase across England, Scotland, Wales, and Northern Ireland. Workers aged 21 and over must receive £12.71 per hour. Younger age bands and apprentice rates also rise.

At the same time, the new Fair Work Agency begins operations in April 2026, replacing HMRC’s standalone minimum wage enforcement with a single body that can investigate minimum wage, holiday pay, and statutory sick pay together.

For domiciliary care agencies, supported living providers, and care homes, the risk does not sit in the headline rate. It sits in travel time, deductions, sleep-ins, salaried hours, and record-keeping. If your effective hourly rate falls below the legal threshold in any pay reference period, you face arrears, penalties of up to 200%, and public naming.

Confirmed National Minimum Wage and National Living Wage rates from 1 April 2026

The Government accepted the Low Pay Commission’s recommendations in full. The new National Minimum Wage rates apply from 1 April 2026 across England, Scotland, Wales, and Northern Ireland.

Here are the confirmed rates:

| Category | Rate from 1 April 2026 |

| National Living Wage (aged 21 and over) | £12.71 per hour |

| 18–20 year olds | £10.85 per hour |

| 16–17 year olds | £8.00 per hour |

| Apprentice rate | £8.00 per hour |

| Accommodation offset | £11.10 per day |

What this means in monthly terms

For employers calculating Minimum wage UK 2026 per month, use hours worked, not assumptions.

Example:

- 37.5 hours per week at £12.71

- Weekly pay: £476.63

- Monthly pay (average): approx. £2,065 before tax

Actual take home pay depends on tax code, pension deductions, and any salary sacrifice arrangements. Minimum wage compliance looks at gross pay before tax, not net pay received.

Scotland, London, and regional confusion

Some employers search for “minimum wage Scotland” or “minimum wage 2026 UK London.” The statutory National Minimum Wage is the same across the whole UK. Scotland and London do not set separate legal minimum wage rates.

However, the voluntary London Living Wage (set by the Living Wage Foundation) is higher than the statutory minimum. Paying it does not remove your obligation to comply with statutory minimum wage rules.

Now let’s look at what these increases actually cost care providers in real terms.

What the National Minimum Wage increase really costs a care business

The National Minimum Wage 2026 rise looks modest on paper. In practice, it reshapes your entire cost base.

Start with the headline figure:

- £12.71 per hour for workers aged 21+

- 37.5 hours per week

- Annual gross pay increases by roughly £975 per worker

That number alone does not break a business. The compounding effect might.

1. On-costs rise automatically

When base pay rises, everything calculated as a percentage rises with it:

- Employer National Insurance

- Workplace pension contributions

- Holiday pay accrual

- Statutory sick pay exposure

- Overtime rates linked to basic pay

From April 2025, Employer NI increased to 15% with a reduced threshold. That change already tightened margins. April 2026 layers another wage uplift on top.

2. Travel time multiplies the impact (domiciliary care)

In homecare, you do not pay only for contact time. Travel time between visits counts as working time for National Minimum Wage purposes.

If travel time represents 15–25% of working hours, the wage increase applies to that portion too.

If you currently pay:

- £12.71 for contact time

- But fail to fully include travel time in payroll

Your effective hourly rate may already sit below minimum wage 2026 once you divide total pay by total working time.

3. Care sector margins remain thin

Independent care providers operate in a fee environment that rarely matches actual employment costs. Employment costs typically represent 70–80% of total provider expenditure.

When statutory rates rise, but commissioner fees stay static, providers absorb the difference.

That tension explains why compliance failures often arise from payroll structure errors, not deliberate underpayment. However, regulators do not treat financial pressure as a defence.

The math is simple:

Higher base rate

- Higher on-cost percentage

- Travel time inclusion

- Variable hours = Narrower margin for error

Now add enforcement.

Let’s look at how the Fair Work Agency changes the compliance landscape from April 2026.

RELATED: New Rules for Care Home Payments in 2026

Fair Work Agency payroll checks: what changes from April 2026

From 7 April 2026, the Fair Work Agency (FWA) begins operations as the UK’s single labour market enforcement body. It replaces HMRC’s standalone National Minimum Wage enforcement function and brings several enforcement streams under one structure.

This is not a cosmetic change. It shifts how investigations start, how far they reach, and what they examine.

What the Fair Work Agency consolidates

The FWA combines:

- HMRC’s National Minimum Wage enforcement

- The Employment Agency Standards Inspectorate

- The Gangmasters and Labour Abuse Authority

It also gains authority to enforce additional employment rights, including holiday pay and statutory sick pay, rather than waiting for workers to bring tribunal claims.

For care providers, that means one investigation can now cover:

- National Minimum Wage

- Holiday pay calculations

- Sick pay compliance

- Record-keeping standards

- Agency worker compliance (where relevant)

Expect more payroll checks, not fewer

Some providers search for phrases like “HMRC wage raid payroll checks.” The reality is less dramatic but more structured.

The FWA can:

- Enter premises to inspect records

- Require payroll, time sheets, and contracts

- Issue Notices of Underpayment

- Impose penalties of up to 200% of arrears (capped at £20,000 per worker)

- Publicly name employers

If you pay arrears quickly, the penalty can reduce to 100%, but that still doubles the financial exposure.

Why the care sector sits in the spotlight

Enforcement bodies consistently prioritise sectors where:

- Pay sits at or near the National Minimum Wage

- Workers have variable hours

- Travel time and split shifts create complexity

- Employers rely on zero-hours or flexible contracts

Domiciliary care, supported living, and care homes match that profile precisely.

Record-keeping now matters more than ever

The Employment Rights reforms introduce stronger record-keeping expectations, particularly around holiday entitlement and pay. Investigators will expect six years of accessible, accurate records.

If you cannot demonstrate compliance, you assume non-compliance.

In short, April 2026 brings higher pay rates and broader enforcement at the same time. Care providers must prepare for structured, evidence-based payroll scrutiny, not just headline wage checks.

Now, let’s look at the six compliance traps that most often trigger underpayment findings in care.

Why care providers underpay minimum wage without meaning to

Most care providers do not deliberately breach the National Minimum Wage. They fall into calculation traps.

Investigators do not ask, “What hourly rate does the contract say?”

They ask, “What was the worker’s effective hourly rate across the pay reference period?”

If total pay that counts ÷ total working time that counts falls below minimum wage 2026, you face arrears.

Here are the six traps that trigger enforcement in domiciliary care, supported living, and care homes.

1) Travel time between visits (domiciliary care risk)

In homecare, travel between appointments counts as working time for National Minimum Wage purposes.

If you:

- Pay £12.71 for contact time

- Fail to pay fully for travel time

- Or underestimate travel time systematically

You reduce the worker’s effective hourly rate.

Example:

- 6 contact hours paid at £12.71

- 1.5 hours travel unpaid

- Worker actually worked 7.5 hours

You divide total pay by 7.5 hours, not 6.

That difference alone can push pay below UK minimum wage increase 2026 thresholds.

If you use estimated travel time, document your method and test it against real routes regularly.

2) Deductions that reduce minimum wage pay

HMRC and the Fair Work Agency assess what the worker actually receives.

Certain deductions reduce minimum wage pay, including:

- Required uniforms (even “black trousers and shoes”)

- DBS check deductions

- Training cost recovery agreements

- Administration fees

- Salary sacrifice arrangements

- Payroll savings schemes

If post-deduction pay drops below the National Minimum Wage, you breach the law, even if the headline rate looks safe.

Many providers paying above minimum wage 2026 UK London levels still fail compliance because deductions erase the buffer.

3) Sleep-ins versus on-call (supported living risk)

The Supreme Court clarified that genuine sleep-in hours do not require minimum wage if the worker can sleep and only respond if needed.

However:

- Time spent awake and working must be paid at minimum wage.

- Records must show when the worker woke and worked.

If staff remain on-call and must stay awake or remain ready to work continuously, you must pay minimum wage for the full period.

Poor documentation, not intent, often creates arrears.

4) Unpaid training, induction, and meetings

Mandatory training counts as working time.

That includes:

- Induction before first shift

- E-learning modules

- Safeguarding updates

- Team meetings

If you require attendance, you must pay for it.

Providers frequently breach National Minimum Wage 2026 rules by assuming training outside rostered hours does not count. It does.

5) Salaried hours misclassification

A salary does not protect you from minimum wage checks.

For a worker to qualify as a salaried hours worker under minimum wage rules:

- They must receive an annual salary

- For a fixed number of basic hours

- Paid in equal instalments

If those conditions fail, the worker becomes “unmeasured work” for minimum wage purposes.

If they regularly work beyond basic hours without paid overtime or timely time off in lieu, their effective hourly rate can fall below minimum wage UK 2026 per month equivalents once recalculated.

Investigators now review salaried care managers more closely than before.

6) Apprentice rate errors

The apprentice rate of £8.00 only applies to:

- Apprentices under 19

- Apprentices 19+ in their first year

Once an apprentice turns 19 and completes year one, they move to their age band rate.

Payroll systems often fail to update automatically.

That error creates technical underpayment under National Minimum Wage rules.

The pattern stays consistent:

Most underpayments happen because providers:

- Miscount hours

- Misclassify workers

- Overlook deductions

- Or fail to document working time properly

READ MORE: Zero Hour Agreement in UK Care: How to Stay Compliant (2026)

Minimum wage compliance test (copy and use this)

If you do one check before April 2026, do this one.

The National Minimum Wage does not test your headline hourly rate. It tests your effective hourly rate across the pay reference period.

Use this formula: Pay that counts for minimum wage ÷ Hours that count as working time = Effective hourly rate

If the result falls below the applicable rate, you breach the law.

Step 1: Calculate pay that counts

Include:

- Basic pay

- Paid travel time

- Shift payments that count toward minimum wage

Exclude:

- Tips

- Genuine expense reimbursements

- Premium overtime elements that cannot count toward minimum wage

Use gross pay before tax.

Step 2: Calculate hours that count

Include:

- Contact time

- Travel time between visits

- Mandatory training

- Required meetings

- Time awake and working during sleep-ins

- Any time staff must be present and available to work

Exclude:

- Genuine rest breaks

- Time completely free from work duties

Step 3: Divide and compare

Example:

- Total qualifying pay in the pay period: £950

- Total working time (including travel and training): 78 hours

£950 ÷ 78 = £12.18 per hour

If the worker is 21+, the required National Living Wage 2026 is £12.71.

You underpaid.

It does not matter if the contract says £13 per hour for contact time. The calculation decides compliance.

With minimum wage 2026 set at £12.71 and enforcement moving to the Fair Work Agency, investigators will request:

- Payroll data

- Timesheets

- Travel logs

- Deduction records

If you cannot show this calculation clearly, you assume risk.

SEE ALSO: RQIA Registration for Domiciliary Care Agency in Northern Ireland (2026)

National Minimum Wage 2026 checklist for care providers

Complete this review before your first April 2026 payroll run. Do not wait for a payroll check to expose gaps.

1) Update every worker to the correct rate

- Move all 21+ workers to £12.71 per hour

- Move 18–20 year olds to £10.85

- Update 16–17 and apprentice rates to £8.00

- Check apprentices aged 19+ who completed year one

- Set reminders for birthdays that move workers into higher bands

Do not assume payroll updates automatically.

2) Run the minimum wage calculation across real pay periods

Take one full recent pay reference period and calculate:

- Total pay that counts

- Total hours that count (including travel and training)

- Effective hourly rate

If it falls below National Minimum Wage 2026, fix it immediately.

3) Audit travel time from rota to payroll

- Does your system record travel time accurately?

- Do you pay for it?

- Do estimates reflect reality?

- Does mileage payment remain separate from time pay?

In domiciliary care, travel errors trigger most arrears findings.

4) Stress-test all deductions

List every deduction that could reduce minimum wage pay:

- Uniform or dress code requirements

- DBS checks

- Training repayment clauses

- Salary sacrifice schemes

- Payroll savings schemes

For each, check whether any pay period drops below minimum wage after deduction.

If it does, redesign the structure.

5) Review salaried staff working hours

- Confirm they meet the definition of salaried hours work

- Track actual hours worked

- Address consistent excess hours

- Pay overtime or provide timely time off

A £54,000 salary does not protect against minimum wage underpayment if hours inflate.

6) Verify sleep-in and on-call rules

- Record time awake and working

- Pay minimum wage for those hours

- Distinguish genuine sleep-ins from active on-call

Document your approach clearly.

7) Prepare for Fair Work Agency scrutiny

Create an evidence pack that includes:

- Payroll summaries

- Time records

- Travel logs

- Deduction policies

- Salary sacrifice documentation

- Holiday pay calculations

Keep records for six years.

8) Model the financial impact properly

Build into your pricing:

- Wage increase at 4.1% (21+)

- 8.5% increase for 18–20 workers

- Employer NI at 15%

- Pension contributions

- Travel time compliance cost

Use this data in discussions with commissioners and private clients.

If you complete these steps, you significantly reduce the risk of arrears, penalties, and public naming under the new enforcement regime.

LEARN MORE: Starting a Care Home in the UK: Best 2026 Guide

What changed in 2024 and 2025, and what next in 2026?

To understand National Minimum Wage 2026, you need to see the pattern.

Minimum wage 2024

In April 2024, the Government expanded the National Living Wage to workers aged 21 and over. That change pulled thousands of younger care workers into the higher rate band overnight.

Providers who relied on historic age assumptions had to adjust quickly.

Minimum wage 2025 UK

From April 2025, the UK minimum wage 2025 for workers aged 21+ rose to £12.21 per hour. Many providers focused on that uplift alone and ignored structural payroll risks.

At the same time:

- Employer National Insurance increased to 15%

- The NI threshold dropped significantly

- Employment costs climbed faster than fee rates

Some employers search for terms like:

- “UK minimum wage rise August 2025”

- “UK minimum wage increase October 2025”

Statutory minimum wage changes take effect in April, not August or October. The October announcements usually relate to the voluntary London Living Wage, not the legal National Minimum Wage.

The Government has delivered consecutive annual increases:

- Minimum wage 2024 – structural age change

- Minimum wage 2025 UK – significant rate increase

- Minimum wage 2026 – further uplift to £12.71

Each year reduces the buffer between your pay structure and the legal threshold.

The gap between the statutory National Living Wage 2026 (£12.71) and the voluntary London Living Wage narrows further. That leaves less margin for payroll errors, deductions, or miscounted hours.

UK cost of living support 2026: what’s real (and what’s not)

Some care providers search for:

- “UK cost of living payment 2026”

- “UK 2025 cost of living payment”

At the time of writing, the Government has not announced new universal Cost of Living Payments for 2026. Previous one-off payments targeted specific benefit recipients during the energy crisis period.

That means you cannot rely on state support to offset wage pressure.

While there is no confirmed broad UK cost of living payment 2026, rising living costs still affect:

- Staff retention

- Recruitment pressure

- Salary expectations

- Overtime demand

Workers compare their take home pay against rent, fuel, and food costs, not against legal minimums.

For care providers, that creates a double pressure:

- You must comply with National Minimum Wage 2026 rules.

- You must remain competitive enough to retain staff.

The statutory rate protects legal compliance. It does not guarantee workforce stability.

Conclusion

April 2026 does not just increase the National Minimum Wage. It raises the standard of evidence regulators expect from care providers.

You can no longer rely on a headline hourly rate and assume safety. Investigators will examine travel time, deductions, salaried hours, sleep-ins, and holiday pay together. They will divide pay by real working hours. If your calculation fails, your defence fails.

Strong providers will treat this moment as an opportunity.

They will:

- Tighten payroll systems

- Strengthen governance oversight

- Document compliance clearly

- Price services sustainably

- Protect both staff and margins

Minimum wage compliance now signals leadership quality. When regulators, commissioners, and staff assess your organisation, they look for systems that withstand scrutiny, not systems that survive on assumptions.

Ready to Make Your Payroll Enforcement-Proof?

A compliant payroll structure does more than meet the National Minimum Wage 2026 threshold. It protects your CQC reputation, shields your business from arrears and penalties, and strengthens commissioner confidence.

Care Sync Experts supports domiciliary care agencies, supported living providers, and care homes across the UK with:

- Full payroll structure audits against National Minimum Wage rules

- Travel time and deduction compliance testing

- Sleep-in and salaried hours classification review

- Holiday pay and record-keeping framework design

- Governance documentation aligned with CQC “Well-Led” standards

- Financial modelling to reflect the UK minimum wage increase 2026

- Evidence pack preparation for Fair Work Agency payroll checks

Whether you are launching a new service, scaling operations, or stress-testing an existing payroll model, we help you build systems that stand up to investigation and stand out to regulators.

Get in touch with Care Sync Experts today to move into April 2026 with clarity, confidence, and compliance.

FAQ

What is the minimum wage in the UK?

The National Minimum Wage is the legal minimum hourly pay employers must give workers. It varies by age and apprenticeship status. From April 2026, workers aged 21 and over must receive at least £12.71 per hour. Younger age bands have lower statutory rates.

What is the minimum wage 2025 in the UK?

From April 2025 to March 2026, the National Living Wage for workers aged 21 and over was £12.21 per hour. Different age bands applied to workers aged 18–20 and under 18. The Government reviews and updates rates each April.

What is the National Living Wage?

The National Living Wage is the highest band of the UK’s statutory minimum wage system. It applies to workers aged 21 and over. It is set by the Government following recommendations from the Low Pay Commission. It differs from the voluntary “Real Living Wage” set by the Living Wage Foundation.

When did minimum wage go up?

The UK increases minimum wage rates each year in April. The most recent increase took effect on 1 April 2026. Previous increases occurred in April 2025 and April 2024. Statutory minimum wage rates do not change in August or October; those months sometimes relate to voluntary Living Wage announcements, not the legal minimum.

Would you like to receive update from CareSync Experts?