New Rules for Care Home Payments in 2026

Text to speech

Duration: 00:00

Font size

Published: 26 Jan, 2026

Share this on:

Are there new rules for care home payments introduced in 2026?

Care home fees in the UK continue to follow the existing means-tested system, with no lifetime cap on care costs and no automatic reduction in care home costs. Families must still plan based on income, savings, and property, as local authorities assess care home payments using the same framework that applied in previous years.

This guide explains what actually applies in 2026, clears up common myths, and shows how care home fees work in practice so families can make informed decisions.

Why So Many Families Expect New Care Home Rules in 2026

Confusion around care home payments in 2026 did not come from nowhere. For several years, the government discussed major reforms to how care is funded in England. These plans received widespread media coverage and created the expectation that care home costs would become more predictable or capped.

Earlier proposals promised changes such as a lifetime cap on care costs and higher thresholds before people would need to pay for their own care. Many families assumed these reforms would eventually take effect, especially after repeated delays.

However, those proposals never became law. By 2026, the government had abandoned them entirely. Despite that, outdated information continues to circulate online, leading many people to believe the care home fees UK system has changed when it has not.

This mismatch between expectation and reality causes real problems. Families delay planning, underestimate care home costs, or assume protections exist that simply do not apply. Understanding what didn’t change in 2026 matters just as much as what did.

Were New Care Home Payment Rules Introduced in 2026?

No. No new care home payment rules have been introduced in 2026 (As of the time of publishing this content).

Despite years of public discussion about reform, the legal framework for paying care home fees in the UK, particularly in England, remains the same.

Local authorities still use a means-tested system to decide who pays for care and how much they contribute. There is no lifetime cap on care costs, and there are no new protections that automatically reduce care home fees in 2026. Families should not assume that care home costs are capped, frozen, or subsidised simply because reforms were previously announced.

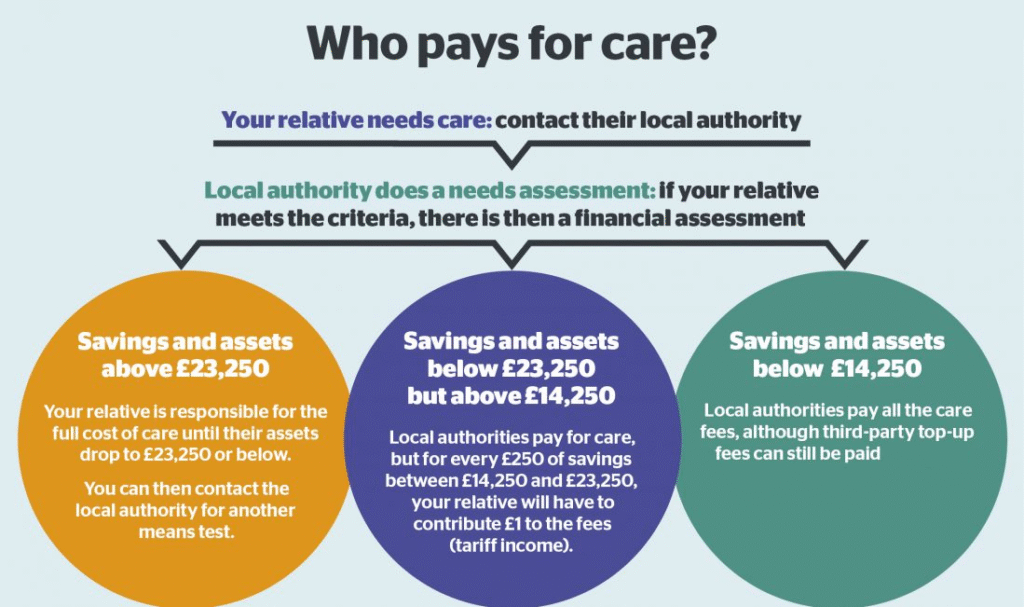

This point matters because many people plan care based on headlines rather than law. In practice, councils continue to assess:

- A person’s income, such as pensions and benefits

- Their capital, including savings and, in some cases, property

- Whether they qualify for full, partial, or no local authority support

The absence of new rules also means responsibility has not shifted. Individuals with assets above the upper threshold still self-fund their care, while those below may receive council support. Nothing in 2026 changes how that assessment works.

It’s also important to be precise about geography. The care funding system discussed here applies primarily to England. Wales, Scotland, and Northern Ireland operate under different frameworks, with their own thresholds and rules. Many online articles blur this distinction, which adds to the confusion.

In short, 2026 did not bring reform, it brought continuity. Any decisions about paying for care home fees must still rely on the existing rules, not on plans that never took effect.

How Care Home Fees Work in the UK in 2026

Care home fees in the UK still work on a means-tested basis in 2026. Local authorities do not pay a flat rate, and they do not cover costs automatically. Instead, they assess each person’s financial situation to decide who pays, how much, and for how long.

When paying for care home fees, councils look at two things first: income and capital.

What Local Authorities Assess

During a financial assessment, the council considers:

- Income, including state pensions, private pensions, and certain benefits

- Capital, such as savings, investments, and, in some cases, property

If a person’s assets sit above the upper capital threshold, they must usually pay their own care home fees in full. If assets fall between the upper and lower thresholds, the council may contribute part of the cost, while the individual pays a means-tested amount. People with assets below the lower threshold receive the highest level of support, although they still contribute from their income.

This process applies whether someone enters a residential care home or a nursing home. It also explains why two people with similar care needs can face very different care home costs.

Why Care Home Fees Vary So Much

Care home fees UK families face differ widely because the system ties costs to personal finances, not just care needs. Location, type of care, and whether someone qualifies for council support all affect the final amount.

In many cases, families only realise how much care home fees can cost once assessments begin. That delay often leads to rushed decisions and unnecessary financial stress.

How Much Can You Keep Before Paying for Care in the UK?

How much you can keep before paying for care in the UK depends on your total capital, not just your income. In 2026, the financial thresholds used by local authorities in England remain unchanged, and they play a central role in deciding who pays care home fees.

Local councils assess capital using two key limits:

- Upper capital limit: If your savings and assets exceed this level, you usually pay the full cost of your care.

- Lower capital limit: If your assets fall below this level, the council provides the highest level of financial support, although you still contribute from your income.

If your capital sits between these two limits, the council applies a means-tested contribution. You pay what you can afford from your income, plus a tariff contribution based on your assets. This structure explains why people with similar savings can face very different care home costs depending on where their capital falls.

It’s important to understand that capital does not only mean money in the bank. Councils may also consider investments and, in some cases, the value of property. Misunderstanding what counts can lead families to assume they must self-fund when support may actually be available.

Because these thresholds determine whether care home costs come from personal funds or council support, knowing where you stand financially allows you to plan early and avoid unnecessary surprises.

What Counts as Capital When Paying for Care Home Fees?

When councils assess paying for care home fees, they look closely at a person’s capital, not just their income. Capital includes assets that someone could reasonably use to contribute toward their care home cost.

Assets That Usually Count as Capital

Local authorities typically include:

- Savings held in bank or building society accounts

- Cash and investments, such as ISAs, stocks, shares, and bonds

- Premium Bonds and similar financial products

- Property or land, if no qualifying exemption applies

These assets form the basis of how councils decide whether someone must self-fund or qualifies for support with care home fees UK families face in 2026.

Assets That Usually Do Not Count

Not everything a person owns counts as capital. Councils normally disregard:

- Personal belongings, including furniture, jewellery, and vehicles

- The value of a home, if a spouse, civil partner, or qualifying dependent continues to live there

- Certain compensation payments or trust funds, depending on how they are structured

This distinction matters. Many families assume all assets count, which leads to unnecessary panic or rushed decisions.

Misunderstanding capital rules can increase care home costs unnecessarily. Some families believe they must sell assets immediately or that council support is unavailable, even when exemptions apply.

Capital assessments depend on individual circumstances, not assumptions. Before making decisions that affect long-term finances, families should understand exactly what councils include and exclude when calculating care home cost contributions.

Does Your Home Count Toward Care Home Costs?

In some cases, yes, your home can count toward care home costs, but it does not apply in every situation. How property is treated often makes the biggest difference to a family’s financial outcome, which is why misunderstandings here cause so much anxiety.

When someone moves permanently into a care home, the local authority may include the value of their home in the financial assessment. This usually happens if the property is empty and no qualifying person continues to live there. In that situation, the home becomes part of the capital used to calculate care home fees.

However, important exemptions apply, and many families overlook them.

When the Home Is Not Included

The council must disregard the value of a home if it remains occupied by:

- A spouse or civil partner

- A partner the person lives with

- A dependent relative, such as a child under 18

- In some cases, a close relative who is elderly or disabled

If any of these conditions apply, the home does not count toward care home costs, even if the person receiving care moves into a residential setting.

Temporary Disregards and Deferred Decisions

Even when a property does count, councils usually apply a temporary disregard period at the start of a care home placement. This gives families time to understand their options instead of making rushed decisions.

Many people assume selling the house is inevitable. In reality, councils often offer deferred payment arrangements, which allow care costs to be paid later from the property value rather than forcing an immediate sale.

Why Property Rules Matter So Much

Property often represents the largest single asset a person owns. Misunderstanding how it affects care home costs can lead families to sell too early or believe support is unavailable when it actually is.

Understanding when a home counts, and when it does not, creates space to plan properly and avoid unnecessary financial pressure.

How to Avoid Selling Your House to Pay for Care

Many families worry that moving into a care home automatically forces them to sell their house. In reality, selling your home is not always necessary, and the system offers lawful ways to manage care home costs without an immediate sale.

Use Property Disregards Where They Apply

If a spouse, partner, or qualifying dependent continues to live in the property, the council must ignore the home’s value during the financial assessment. In these cases, the house does not affect care home fees at all. Families should always confirm whether a mandatory disregard applies before considering any sale.

Ask About Deferred Payment Agreements

When no exemption applies and the property counts as capital, councils often offer a deferred payment agreement. This option allows the person receiving care to delay paying care home fees until the property is sold later, usually after death or when the home is eventually vacated.

With a deferred payment arrangement:

- The council pays the care home fees upfront

- The cost builds as a loan against the property

- Families avoid selling the house under pressure

This approach gives families time and flexibility while ensuring care continues.

Avoid Rushed Decisions That Increase Costs

Some people try to transfer ownership of property or give away assets to avoid paying care home costs. Councils treat this as deliberate deprivation of assets and may still assess fees as if the property were owned.

Trying to bypass the rules often backfires and leads to higher long-term costs. Planning early and using recognised options protects both finances and peace of mind.

The best way to avoid selling a house to pay for care is understanding the rules before care becomes urgent. Early advice allows families to explore exemptions, payment arrangements, and alternatives without panic.

Are Next of Kin Responsible for Care Home Fees?

In most situations, next of kin are not responsible for paying care home fees. Care costs remain the responsibility of the person receiving care, not their children, relatives, or family members.

This misunderstanding causes unnecessary fear. Simply being listed as next of kin does not create a legal duty to pay for care.

When Family Members Are Not Liable

You are not required to pay care home fees if:

- You are a son, daughter, or relative with no legal agreement

- You manage finances informally or help with paperwork

- You act as an advocate or support person

Councils assess the care recipient’s finances only, not the family’s income or assets.

When Someone Might Become Responsible

A next of kin may become responsible for care home fees only if they:

- Sign a contract or guarantee agreeing to cover costs

- Choose a care home that charges more than the council’s rate and agree to pay a third-party top-up

- Legally take on financial responsibility through a binding agreement

These situations involve choice, not obligation. No one should feel pressured to sign payment agreements without understanding the consequences.

Many families confuse emotional responsibility with legal responsibility. While relatives often help organise care, the law keeps financial liability separate unless someone actively agrees to take it on.

Understanding this distinction helps families plan care without unnecessary guilt or fear.

Do Dementia Sufferers Have to Pay Care Home Fees?

Yes, in many cases people with dementia do have to pay care home fees. A diagnosis of dementia on its own does not remove the requirement to contribute toward care home costs. The same financial assessment rules apply as they do for any other condition.

This often surprises families, especially when dementia leads to high and long-term care needs.

Why Dementia Does Not Automatically Remove Fees

Local authorities base care home fees on financial circumstances, not diagnosis. Even when someone lacks mental capacity or requires specialist dementia care, councils still assess income and capital in the same way.

That said, dementia can affect how care is funded, depending on the level and type of care required.

When NHS Funding May Apply

Some people with dementia qualify for NHS Continuing Healthcare, which covers the full cost of care, including accommodation. This funding depends on whether the person’s primary need is health-related rather than social care.

Eligibility does not depend on savings or property. Instead, it relies on a detailed assessment of care needs. Many families miss out because they assume dementia automatically qualifies someone for NHS funding, which is not the case.

The difference between local authority funding and NHS funding can be significant. Families should always request a proper assessment and challenge decisions where appropriate.

Understanding the distinction helps families avoid paying care home fees unnecessarily and ensures the right funding route applies.

How Much Do Care Homes Cost Per Week in the UK?

Care home costs in the UK vary widely, but in 2026 most families can expect to pay several hundred pounds per week, with prices rising significantly for nursing or specialist care.

On average:

- Residential care homes often charge £700 to £1,000 per week

- Nursing care homes commonly charge £900 to £1,400 per week or more

- Specialist dementia care can exceed these ranges, depending on care intensity and location

These figures reflect national averages. Actual care home costs depend heavily on where the home is located, the level of care required, and whether local authority funding applies.

Why Weekly Care Home Costs Differ So Much

Care home fees UK families face are not fixed prices. Providers set fees based on:

- Staffing levels and qualifications

- Type of care (residential, nursing, dementia)

- Property costs and facilities

- Regional demand and local wage levels

Homes in London and the South East typically charge more than those in other regions. A basic residential placement may cost far less than a high-dependency nursing bed, even within the same area.

What These Numbers Mean for Planning

Weekly care home cost figures add up quickly over time. Without council support or NHS funding, long-term care can place significant pressure on savings and property.

This is why understanding funding rules, assessments, and alternatives matters before care becomes urgent.

Why Care Home Costs Vary So Widely

Care home costs vary widely because no single factor determines pricing. Providers set fees based on a combination of care needs, location, staffing, and facilities, not just the length of stay.

Location Plays a Major Role

Geography strongly influences care home cost. Homes in areas with higher property prices and wages, such as London and the South East, usually charge more. In contrast, care homes in other regions often operate with lower overheads, which can reduce weekly fees.

Level and Type of Care Required

The type of care makes a significant difference. Residential care costs less than nursing care because nursing homes require registered nurses on site. Dementia care often costs more again, as it demands higher staffing ratios, specialist training, and enhanced safety measures.

Staffing and Quality Standards

Staffing represents one of the largest expenses for care homes. Homes that invest in experienced staff, continuous training, and higher staff-to-resident ratios often charge more. These costs reflect the level of care provided, not unnecessary mark-ups.

Facilities and Services

Modern facilities, private rooms, en-suite bathrooms, specialist equipment, and additional services all affect pricing. While these features do not change funding rules, they influence how care home costs compare between providers.

Why Comparing Prices Alone Can Mislead

Two care homes may charge very different fees while meeting the same regulatory standards. Comparing care home cost without considering care quality, staffing, and suitability often leads families to choose poorly.

Examples of Care Home Costs in Practice

Care home costs often make more sense when you see how they play out in real situations. While every provider sets its own fees, examples help show why prices differ and what families usually pay for.

Example 1: Residential Care in a Standard Setting

A care home similar in profile to Fairview Care Home may focus on residential support for older adults who need help with daily living but not constant medical care. In this type of setting, weekly costs often sit at the lower end of the national range.

Fees usually reflect:

- Personal care and supervision

- Meals and accommodation

- Basic activities and social support

For many families, this level of care meets current needs without the higher costs associated with nursing or specialist services.

Example 2: Nursing or Dementia-Focused Care

A home comparable to Woodland Care Home may provide nursing care or specialist dementia support. These homes typically charge more because they operate with:

- Registered nurses on site

- Higher staffing ratios

- Specialist dementia training and secure environments

Even within the same area, this type of care can cost several hundred pounds more per week than standard residential care.

What These Examples Show

These comparisons highlight an important point: care home costs reflect care complexity, not just accommodation. Two homes may appear similar from the outside but charge very different fees because they meet very different needs.

Families often focus on price alone, but choosing the wrong level of care can lead to additional moves, reassessments, and stress later on. Matching care needs to the right setting matters as much as managing cost.

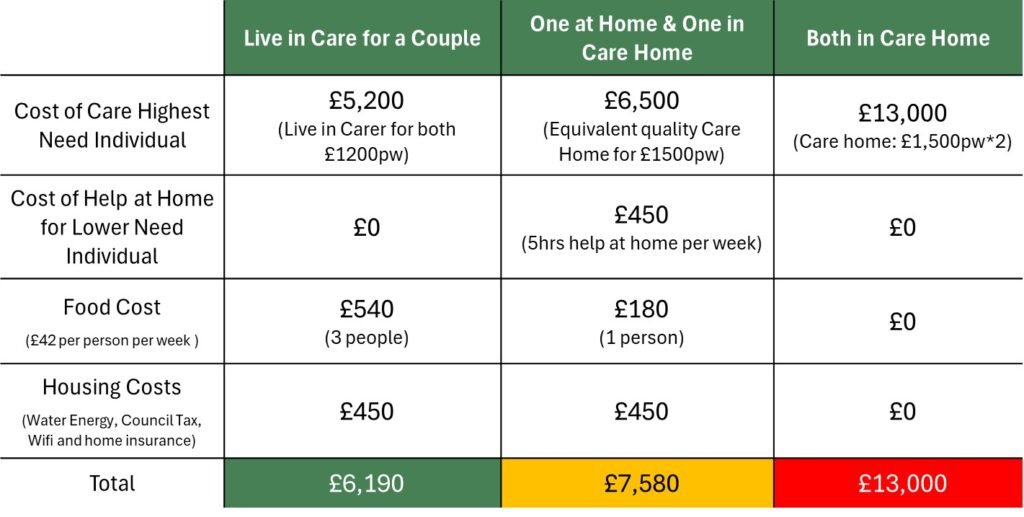

Is Care Home Funding the Same as Home Care Funding?

Care home funding and home care funding follow similar principles, but they work very differently in practice. Understanding the difference helps families compare options realistically instead of assuming costs apply in the same way.

How Funding Assessments Compare

Both types of care usually involve:

- A care needs assessment by the local authority

- A financial assessment to determine contributions

In both cases, councils look at income and capital. However, how those assets affect costs changes depending on where care takes place.

The Key Difference: How Property Is Treated

The most important difference lies in property.

- Care home funding:

When someone moves into a care home permanently, the value of their home may count toward care home fees unless an exemption applies.

- Home care funding:

When someone receives care at home, the value of their property does not count at all. Councils exclude it because the person continues living there.

This distinction explains why some people who must self-fund a care home may still qualify for council support when receiving care at home.

Income Is Treated Differently Too

Income rules also differ:

- People in care homes usually contribute most of their income toward fees, keeping only a small personal expenses allowance.

- People receiving care at home retain more income to cover everyday living costs such as food, utilities, and housing.

Families often assume moving into a care home is the only option when care needs increase. In reality, home care can remain affordable for longer because funding rules are more flexible.

Comparing funding across care settings allows families to weigh cost, independence, and long-term sustainability rather than making decisions under pressure.

What Families Should Do Next When Planning Care in 2026

Planning care in 2026 requires clarity, not assumptions. Because the new rules for care home payments did not materialise, families must base decisions on the system that already exists.

Start by understanding the full picture:

- Do not assume care home costs are capped. There is no lifetime cap on care costs in place.

- Review finances early. Look at savings, income, and property before care becomes urgent.

- Request proper assessments. A care needs assessment and a financial assessment determine support, not diagnosis alone.

- Understand property rules. Know when a home counts toward care home fees and when exemptions apply.

- Avoid rushed decisions. Selling property or signing payment agreements under pressure often leads to avoidable costs.

- Ask about alternatives. Home care or deferred payment arrangements may reduce immediate financial strain.

- Seek regulated advice. Complex cases benefit from professional guidance before long-term commitments are made.

Families who plan early have more options. They avoid unnecessary sales, challenge incorrect assumptions, and make choices that fit both care needs and financial reality.

Care funding remains one of the most complex parts of the UK care system. Understanding how it actually works in 2026 gives families the confidence to act, rather than react.

Care Home Payments in 2026: Key Points at a Glance

- No new rules for care home payments were introduced in 2026.

- Care home fees in the UK continue to follow a means-tested system.

- There is no lifetime cap on care costs in place.

- Local authorities assess income, savings, and, in some cases, property.

- People with assets above the upper threshold usually self-fund their care.

- A person’s home may count toward care home costs, unless an exemption applies.

- Next of kin are not automatically responsible for paying care home fees.

- Dementia does not remove the requirement to pay care home fees, although NHS funding may apply in some cases.

- Care home costs vary widely based on location, care type, and care needs.

Need clarity on care home funding decisions in 2026?

Paying for care often becomes urgent before families fully understand the rules. Confusion around care home fees, property assessments, and funding thresholds can lead to rushed choices that increase long-term costs.

Care Sync Experts helps families and care providers across England, Wales, and Northern Ireland understand how care funding works in practice, before financial pressure forces difficult decisions. Support typically includes:

- Clear explanations of care home funding rules and assessments

- Guidance on property treatment, exemptions, and deferred payment options

- Support understanding eligibility for local authority or NHS funding

- Practical planning to avoid unnecessary asset loss

- Independent, regulation-aligned advice grounded in current UK guidance

Book a free initial consultation

If you’re unsure how care home costs will be assessed, whether property will be included, or what options exist before committing to long-term care, a short conversation now can prevent avoidable stress later.

This article reflects UK care funding rules and sector practice as at 2026. Funding decisions depend on individual circumstances and may change. Families should always refer to current guidance from the relevant local authority or regulator.

FAQ

Can the government take your house to pay for care in the UK?

The government does not usually “take” your house outright. If you move permanently into a care home, the local authority may include your home’s value in the financial assessment if no qualifying person still lives there.

If you qualify for a deferred payment agreement, the council can pay fees upfront and recover the money later from your estate, often by placing a legal charge against the property rather than forcing an immediate sale.

What happens when money runs out for care home UK?

If someone self-funds and their savings fall below the upper threshold, they should contact the local authority early and request a financial assessment.

From that point, the council may begin contributing to care costs, but it may not pay the full care home fee, especially if the home charges more than the council’s usual rate. In that situation, the person may need to:

– move to a home within the council’s budget,

– or arrange a third-party top-up (someone else pays the difference), if available.

Planning ahead matters because delays can create arrears and reduce options.

How much does a caare home cost per month in the UK?

A monthly estimate depends on the weekly fee. Many care homes charge hundreds to over a thousand pounds per week, so monthly costs commonly land in the low-to-mid thousands.

A simple way to estimate:

Weekly fee × 52 ÷ 12 = monthly cost

Example:

£900/week → £900 × 52 = £46,800/year → ÷ 12 ≈ £3,900/month

This varies by region, care type (residential vs nursing), and whether specialist dementia support is needed.

What is the 7 year rule for care home fees in England?

There is no fixed “7-year rule” that guarantees protection from care fee assessments. People often confuse care fee rules with inheritance tax gifting rules.

In England, councils look at whether someone deliberately reduced assets to avoid care charges (often called deprivation of assets).

If the council decides a person gave away money or property to reduce care costs, it may still treat them as if they still own those assets, regardless of how long ago the transfer happened.

Because this area is fact-specific, families should get proper guidance before making major transfers.

Would you like to receive update from CareSync Experts?